| built by pilots who teach the world to fly...proud manufacturers of Aviator Aircraft and other aircraft brands. | |

| Corporate Office: Jacksonville FL Cell: 904-714-5724 info@aviationtpi.com | ||

With new training aircraft, expert instructors and the latest technologies teaching the world to fly.

We import and export from all regions of the planet to share the quality and workmanship that is part of every pilot's soul.

Our website has been tested in all major browsers.

This is a media rich website best viewed with IE for windows media streams. There are also Flash video presentations as well that requires flash enabled, but it will interfere with the menus, just click on Home if it blocks your selection.

With support and exchanging new technologies with aviation corporations around the world ATPI is here to help you grow with a love of the art flying, the freedom to express that transcends borders and politics.

Comprised of 3 distinct subsideriaries, ATPI completes the Circle. Our training division deployes new teaching technologies to cover all aspects from begining pilot to airline transport with skills not normally taught.

Our manufacting division designs and builds training and private aircraft for the retail consumer, with new versions of the Tiger and Cougar aircraft series.

Our research division works closely with other innovators to develop next generation of flight such as Air-taxi's, autonomous vehicles, and drone technologies.

Samuel W. Miller, ScD, PhD, JD - Current CEO of ATPI Inc and Chairman of the Board, Designer of the Aviator Aircraft Series

Samuel W. Miller, ScD, PhD, JD - Current CEO of ATPI Inc and Chairman of the Board, Designer of the Aviator Aircraft Series

Chuck Vaughn, ATP - Current CFO of ATPI Inc and Director of Sales and Marketing, Facilitor between all resources of ATPI

Chuck Vaughn, ATP - Current CFO of ATPI Inc and Director of Sales and Marketing, Facilitor between all resources of ATPI

GEORGE A. SMITH, JR., C.M. - Current COO of ATPI Inc.and Director of Operations, Makes the wheels and props turn.

GEORGE A. SMITH, JR., C.M. - Current COO of ATPI Inc.and Director of Operations, Makes the wheels and props turn.

Just call or send us an email and tell us what you need or want to accomplish. From there we will contact you to make the necessary arrangements from customizing, ordering and delivery.. every customer gets personal treatment which is why there is no shopping cart. This is not a gift shop ...

While are located in the USA, we provide services and support worldwide. If we cannot get there in a reasonable period of time, we will find a way.

Due to the volume it is best to use our contact button or simply email us, but if you are in a hurry feel free to call us at 904-714-5724 between 8AM and 5PM GMT-5 Monday through Friday.

As a US Company we follow UCC business practices and UNCITRAL rules for international transactions (what makes bank ATM's valid) under UCP600 guidelines. As such, emails have the same power as a written receipt and provides the safety of documented transactions - means no need for paper.

First and foremost, when it comes to flying we have done it all at one point and are doing stuff you have not seen yet. Just ask... we can help you.

Just click on the Contact button and provide us your full contact information and we will send you the information needed to start the submission process. It is that easy, but we can be very selective.. which does not reflect on your request. So do not take it personally ! Well maybe...but we try to be nice.

You should be prepared to provide a detailed description of what you want to do. Bear in mind that we have 3 divisions and may deploy contact with each of them to get you what you really need.

We will also need to know payment methods acceptable to you along with shipping arrangements and/or scheduling. Some requests simply cannot be done and we can tell you what is realistic over what time.

Aviation Flight Academy Pro Forma Projections

Aviator Aircraft Pro Forma Projections

Single Engine Aircraft Projections

ATPI - Gainesville Flight Center

Aviation Training Partners International, Inc.

“ATPI”

Chuck Vaughn, ATP

Director of Sales and Marketing, CMO

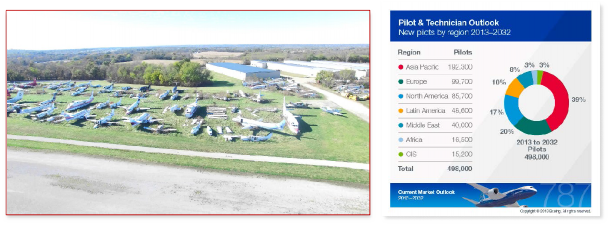

500,000 NEW PILOTS NEEDED BUT ONLY TRAINING RESOURCES AVAILABLE FOR 30,000

MOST AIRCRAFT IN TRAINING FLEETS ARE OVER 20 YEARS OLD LACKING MODERN AVIONICS AND DWINDLING FASTER THAN PRODUCTION FROM AIRCRAFT MANUFACTURERS

NEW MODERN AIRCRAFT ARE BOOKED YEARS IN ADVANCE BEFORE COMING OFF THE PRODUCTION LINE SO THE PATH TO COMMERCIAL PILOTS IS ALMOST CUT-OFF

NEW FAA GUIDELINES REQUIRE MORE TIME FOR COMMERICAL PILOTS TO QUALIFY TO FLY AS SECOND IN COMMAND SO PATHWAY RESTRICTED TO AIRLINES

PILOTS GRADUATING ARE NOT PREPARED WITH OTHER ESSENTIAL SKILLS DUE TO COST SAVINGS IN TRAINING

NEW ADVANCES IN DRONE TECHNOLOGY PAVED THE WAY FOR NEW PASSENGER AIR-TAXI DRONES BUT NO MAJOR

DEVELOPER OR FAA REGULATIONS PLACING USA BEHIND OTHERS

How to make the bridge from the old to the new before it’s too late?

Aviation Training Partner’s International Inc.

The need for aircraft and pilots is ever increasing and the training of pilots is becoming more demanding as new technology is applied to the airspace above our heads. Aircraft traditionally used for training are now often over 20 years old and do not have the avionics in them to adequately train commercial pilots. The replacement cost for atypical glass cockpit aircraft is easily $500,000 each and on the best day can service 2 to 3 pilots in their training schedule. Even the small flight schools will be lucky to have one of these aircraft, while the others are dials and gauges to give them the basics of flight. Commercial pilots need allot more than this, and companies that have twin engine aircraft are fully booked so far in advance they cannot keep up with the demand creating only a possible 30,000 pilots in the time frame that 500,000 pilots are needed. Add to that new FAA regulations in the USA for minimum number of flight hours before they can get experience enough to sit in second in command makes this number even smaller if resources are not changed. This is not just a USA problem either, this is a global problem and the quality of the pilots who are lucky enough to find the resources are suffering as well.

The FAA has allowed more training on simulators to compensate for the lack of aircraft and resources to help pilots get more experience, but there is a limited number of full flight simulators needless to say simulators that are designed specifically for a given type of aircraft, such as Phenom, Citations, 737’s, and many others which also require currency to remain proficient in emergency procedures. So where are the 500,000 pilots going to maintain their proficiency even if the aircraft are made available by massive increases in production? Not this way shown below:

Technology itself is expediting the drastic change in aviation with drone technology, most flown in the amateur realm, that technology is being applied to monitored and autonomous vehicles creating a new localized transportation means called passenger air-taxi’s. While still in the development stage, some countries are already entering beta test mode. This technological leap will be available within the next 20 years in the USA, but it has limitations due to flight duration. Most certainly we would not want someone flying over our heads that is producing 2,000 lbs. of thrust without at least knowing where the ballistic recovery parachute is or having someone monitoring the flight able to flip the switch.

Aviation Training Partner’s International Inc., was formed to resolve these issues by bringing technologies and resources together. In order to accomplish this a multifaceted corporation was required that addresses flight training aircraft to meets the needs that could be produced in the time frame required, appropriate training staff and equipment made available within the training environment that takes pilots from beginners through their PIC ratings not just obtaining their commercial ticket in a beat up twin engine aircraft, and finally, creating new technological applications to integrate those with no flying experience and providing the expertise to deal with that new technologies to the safe implementation with the FAA.

We realize that is a mouthful, so to help you understand we have broken it down a bit.

We pointed out that new glass cockpit aircraft cost over $500,000 but that does not mean that an aircraft cannot be produced significantly less at a profit that is also glass cockpit. Several aircraft type certificates are already available such as the Tiger and Cougar aircraft series, that when

produced new would resell in the low $300,000 range. Also, our staff has extensive experience designing and building new aircraft and can easily produce new aircraft designed using modern construction techniques within 3 years that would allow beginner pilots to become commercial twin engine pilots. These aircraft are designed for training and commercialization that would be within the modern family budget and more so allow other training centers to replace their aging fleet.

Currently the FAA has a multi-level flight training structure for a very good reason. Sport aircraft, to private pilot, to commercial pilot to airline transport pilot. Within each of those certifications,

various skills are added, such as single engine, multi-engine, and type ratings for specific aircraft. As an example, a single engine pilot who flies under visual rules only would not be able to land a 737 in the midst of a thunderstorm because he would not know how to operate the systems of the aircraft, navigate properly using the information those systems are telling him or control the aircraft itself because of the complexity of the environment the aircraft operates in. As a pilot matures from dreams of basic flight to become an ATP, is a series of staged experiences and exposure from the classroom, simulated environment to practical application. This process is repeated many times over until the student becomes either proficient or quits. Some quit because of the severe economic impact of flight training, others quit because they do not understand the importance of the training they are receiving, and some simply should never be pilots because they lack the technical comprehension. What is more alarming there are pilots who test so many times they eventually pass the training and are now flying passengers.

This does not have to be…

Each stage of the pilot learning environment must be orchestrated and positively supported to foster that understanding. This requires good ground school, demonstration by qualified instructors, actual simulation as close to real world as possible, in the actual aircraft as practical without actually endangering anyone, and finally diversity in type of aircraft to set home those building blocks. ATPI is comprised of real pilots and instructors who have extensive experience in a variety of different aircraft and types, and all would say that it is not one aircraft that has given them that expertise, but the combination of aircraft that honed their skills. At each ATPI center,

these resources will be placed and overseen to ensure that each pilot has had that level of training that is instinctive and not just memorized to pass the test.

The most obstructive inhibitor of a potential ATP is the cost and hours required. Modern simulators provide drastic cost savings to the student, but most training centers do not have them or minor versions of them, often treated more of a video game because the old-style stick and rudder instructors do not know how to use them in their syllabus. However, modern simulators are capable of giving real experience and companies such as Flight Safety and Simuflite use them to type certify pilots who have never step foot in the aircraft they became certified to fly. At ATPI, the use of full flight simulators is specifically used to teach as part of the syllabus, and more so to allow students that extra time to sort out the issues they are having with any part of their training. The FAA has now accepted this as part of the time requirements for Instrument Flight Training certification. At ATPI, we see this as a move in the right direction as we can teach our students in that simulated environment things we would not dare teach them in the real aircraft because of the risk. What that equates to is pilots who graduate who actually are ready for what can happen, and from our experience does.

Simply put.. autonomous vehicles are coming and there is no reason to put our head in the sand.

Yup.. they are coming here and in Asia already. While we do not see the trust of the public allowing un-monitored flight, monitored flight is a different thing, and that will require control systems and pilots in charge of those systems as well.

The following image is the Ehang Control Center monitoring its test drone. The reality that such control centers are that complicated as a sign that integration into the public is quite unrealistic, verses the image above of a shipborne control center relying upon computational power. Actual beta testing would rely more upon monitored flight and computational power with single pilot monitoring similar to military done operations.

With the wide variety of autonomous passenger air-drones in development, there is most certainly the need for qualified pilots to perform this function as this technology comes to the USA. That training will be an integral part of the future at ATPI through its training programs.

Being conservative and using only Boeing’s projections show that 26,000 ATP’s must graduate each year and have a minimum of 1,500 flight hours in twins. Easily another 72,000 commercial pilots must graduate each year to start reaching the ATP entry point. Therefore, the commercial training programs in the USA should be at minimum 26,000 students but only 1,600 graduated under the current system. That means 13,000,000 flight hour potential and in best case scenario maximizing aircraft time over 1,000 single engine and another 1,000 multiengine training aircraft are needed in the USA alone without replacements. That does not include retail sales of aircraft, or other commercialization of them. Just within the USA market alone, the production of training aircraft would easily yield a 2:1 Return on Investment on the initial offering alone and would continue globally.

Again, retail flight training costs are typically $10,000 for private, $20,000 for commercial and

$50,000 for ATP conservatively. Even if ATPI got 1% of the students in the USA, would equate to 216 new students per month which is twice the largest commercial flight training center in the USA currently can train in one year spread between 34 flight training centers under the old process and old aircraft. With the use of simulators as part of the syllabus these retail costs can be driven down drastically because the volume of students could increase through the programs. Further the quality of education and experience would increase as well. Simply put, our training programs would become the gold standard globally as we could expand on resources for the next 19 years.

Initially, ATPI will establish its first training center in Jacksonville Florida and its FAA 141 certification as a flight school. While this center is strictly intended to be a test bed on integration of the syllabus and resources. Over the next 3 years, the parallel focus on aircraft type and plant certification with the FAA will occur, along with building the single engine and multi-engine training aircraft. Once type certification is completed which is assured, ATPI will go hard cash positive with the release of its training programs either as direct owned centers or authorized centers (such as expected in Europe and Asia markets).

100,000 Units by Investors

1,000,000 Units will be set aside for additional expansions

1,000,000 Units by its Founders who have turned their resources and holding to ATPI

1.500,000 Units kept in reserve for employee incentives

Total Units outstanding: 6.4 million units

Aviation Training Partners International Inc. will be dependent on our ability to meet the goals set forth in this Business Plan during the next 60 months.

With the drastic need for pilot training over the next 19 years, ATPI has a huge market available to it by solving this multifaceted problem collectively by:

Development of low cost modern training aircraft

Integration of new technologies to enhance the training programs

Marketing and Advertising to spread those programs globally

No competition as no single company is collectively providing these services

Ability to take leading edge technologies in aviation and be at the head of its introduction

https://www.facebook.com/siamagmedia/videos/2201880473379199/

https://www.economist.com/science-and-technology/2018/03/10/passenger-drones-are-a-better-kind- of-flying-car

https://newatlas.com/passenger-drone-flying-taxi/51539/

https://www.boeing.com/commercial/market/pilot-technician-outlook/2018-pilot-outlook/

https://www.prnewswire.com/news-releases/boeing-forecasts-unprecedented-20-year-pilot-demand- as-operators-face-pilot-supply-challenges-300684641.html

******* https://www.thebalancecareers.com/boeing-announces-ab-initio-flight-training-program- 282861

******* http://www.boeing.com/resources/boeingdotcom/commercial/market/boeing-market- insight/assets/downloads/pilot-shortage-thought-leadership-2018%20.pdf

Aviation Training Partners International, Inc.

August, 2018

Aviation Training Partners International, Inc.

CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM

Sale of 10,000 Offered Series ‘A’ Non-Voting Units @$2,500 per Units

Each Unit consist of 1 Redeem Value @$2,500 and 100.000 Series A Common Units

Maximum Offering: $250,000,000

The information contained in this Confidential Private Placement Memorandum (this “Memorandum”) has been supplied by ‘Aviation Training Partners International. (“we”, ‘Aviation Training Partners International’ or the “Company” or “ATPI”). Any estimates, forecasts or other-forward looking statements contained in this Memorandum have been prepared by the management of ‘ATPI’ in good faith on a basis it believes is reasonable. Such estimates, forecasts or other forward-looking statements involve significant elements of subjective judgment and analysis, and no representation can be made as to their attainability. No representation or warranty (express or implied) is made or is it to be relied upon as a promise or representation as to the future performance of ‘Aviation Training Partners International Inc.’.

‘Aviation Training Partners International, Inc.’ (“ATPI” is offering (the “Offering”) for sale to persons who qualify as “accredited investors,” investors as that term is defined in Regulation D under the Securities Act of 1933, as amended (the “Securities Act”), up to 100,000 Offered Series ‘A’ Non-Voting Units (the “Maximum Offering”). The per Unit purchase price is equal to $2,500 (the “Offering Price”). No market exists for the trading of any of the Series ‘A’ Non-Voting Unit Series. See “Restrictions on Transfer of Units.”

An investment in ‘Aviation Training Partners International Inc.’ involves a high degree of risk. See ‘Risk Factors” below. Prospective investors are encouraged to retain their own professional advisors to review and evaluate the economic, tax and other consequences of investing in the Offering and should not construe the contents of this Memorandum, or any other information furnished by ‘Aviation Training Partners International Inc.’, as tax or legal advice.

This Memorandum has been prepared by ‘Aviation Training Partners International Inc.’, and no representation or warranty is made by any other person as to the accuracy or completeness of the information contained herein. The appendices attached to this Memorandum constitute an integral part hereof. Prospective investors will be given the opportunity to meet with management and conduct their own due diligence investigations and they must rely on such due diligence, the information disclosed in this Memorandum and the professional advice of their advisors in making their investment decisions.

THE SERIES ‘A’ NON-VOTING UNITS OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES OR “BLUE SKY” LAWS OF ANY JURISDICTION. THE INFORMATION CONTAINED HEREIN HAS NOT BEEN APPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR SIMILAR BODY. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

Number of Series ‘A’ Non-Voting Units Offered | Offering Price | |

Per Unit Total Maximum | 100,000 Offered | $2,500 $250,000,000 |

(1) We are offering a maximum of 100,000 Offered Series ‘A’ Non-Voting Units at the price indicated. See “Terms of the Offering”

THIS MEMORANDUM IS BEING FURNISHED BY THE COMPANY SOLELY FOR USE BY POTENTIAL INVESTORS IN CONNECTION WITH THE OFFERING.

THIS MEMORANDUM HAS BEEN PREPARED BY THE COMPANY, AND NO PERSON OTHER THAN AN AUTHORIZED REPRESENTATIVE OF THE COMPANY HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN THIS MEMORANDUM IN CONNECTION WITH THE UNITS DESCRIBED HEREIN AND, IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE COMPANY. POTENTIAL INVESTORS ARE CAUTIONED NOT TO RELY ON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS MEMORANDUM. STATEMENTS CONTAINED HEREIN AS TO THE CONTENT OF ANY AGREEMENT OR OTHER DOCUMENT ARE SUMMARIES AND, THEREFORE, ARE NECESSARILY SELECTIVE AND INCOMPLETE AND ARE QUALIFIED IN THEIR ENTIRETY BY THE ACTUAL AGREEMENTS OR OTHER DOCUMENTS THE COMPANY WILL MAKE AVAILABLE TO ANY PROSECTIVE INVESTOR, PRIOR TO THE CONSUMMATION OF THE SALE, THE OPPORTUNITY TO ASK QUESTIONS OF AND RECEIVE ANSWERS FROM THE COMPANY OR PERSONS ACTING ON BEHALF OF THE COMPANY CONCERNING THE TERMS AND CONDITIONS OF THE OFFERING, THE COMPANY OR ANY OTHER RELEVANT MATTERS AND ANY ADDITIONAL REASONABLE INFORMATION TO THE EXTENT THE COMPANY POSSESSES SUCH INFORMATION.

THE OFFERING PRICE OF THE SERIES ‘A’ NON-VOTING UNITS HAS BEEN DETERMINED BY THE COMPANY AND DOES NOT NECESSARILY BEAR ANY RELATIONSHIP TO THE ASSETS, BOOK VALUE OR POTENTIAL EARNINGS OF THE COMPANY OR ANY OTHER RECOGNIZED CRITERIA OF VALUE.

BECAUSE THIS MEMORANDUM FOCUSES PRIMARILY ON INFORMATION CONCERNING THE COMPANY RATHER THAN THE INDUSTRY IN WHICH THE COMPANY OPERATES, POTENTIAL INVESTORS MAY WISH TO CONDUCT THEIR OWN SEPARATE INVESTIGATION OF THE COMPANY’S INDUSTRY TO OBTAIN GREATER INSIGHT IN ASSESSING THE COMPANY’S PROSPECTS.

THIS MEMORANDUM DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT MAY BE REQUIRED TO EVALUATE TE OFFERING, AND ANY RECEIPENT HEREOF SHOULD CONDUCT ITS OWN INDEPENDENT ANALYSIS. THE DELIVERY OF THIS MEMORANDUM AT ANY TIME DOES NOT IMPLY THAT THE INFORMATION CONTAINED HEREIN IS CORRECT AS OF ANY TIME SUBSEQUENT TO THE DATE OF THIS MEMORANDUM. THIS MEMORANDUM IS SUBMITTED IN CONNECTION WITH THE OFFERING DESCRIBED HEREIN AND MAY NOT BE REPRODUCED OR USED FOR ANY OTHER PURPOSE. EACH RECIPENT OF THIS MEMORANDUM AGREES THAT ALL INFORMATION CONTAINED HEREIN IS OF A CONFIDENTIAL NATURE, THAT IT WILL TREAT SUCH INFORMATION IN A CONFIDENTIAL MANNER AND THIS IT WILL NOT, DIRECTLY OR INDIRECTLY, DISCLOSE OR PERMIT ITS AGENTS OR AFFILIATES TO DISCLOSE ANY SUCH INFORMATION WITH THE PRIOR WRITTEN CONSENT OF THE COMPANY.

THIS OFFERING CAN BE WITHDRAWN AT ANY TIME BEFORE A CLOSING AND IS SPECIFICALLY MADE SUBJECT TO THE TERMS DESCRIBED IN THIS MEMORANDUM. THE COMPANY RESERVES THE RIGHT TO REJECT ANY SUBSCRIPTION, IN WHOLE OR IN PART, OR TO ALLOCATE TO ANY PROSECTIVE INVESTOR LESS THAN THE NUMBER OF UNITS SUBSCRIBED FOR BY SUCH PROSPECTIVE INVESTOR.

THE PURCHASE OF THE UNITS OFFERED HEREBY ENTATILS A HIGH DEGREE OF RISK. NO INVESTMENT IN THE UNITS OFFERED HEREBY SHOULD BE MADE BY ANY PERSON WHO IS NOT IN A POSITION TO LOSE THE ENTIRE AMOUNT OF SUCH INVESTMENT. ALL INVESTORS SHOULD CAREFULLY REVIEW THIS MEMORANDUM, INCLUDING THE SECTION ENTITLED “RISK FACTORS”.

PROSPECTIVE INVESTORS ARE ENCOURAGE TO RETAIN THEIR OWN PROFESSIONAL ADVISORS TO REVIEW AND EVALUATE THE ECONOMIC, TAX AND OTHER CONSEQUENCES OF INVESTING IN THIS PRIVATE OFFERING AND ARE NOT TO CONSTRUE THE CONTENTS OF THIS MEMORANDUM OR ANY OTHER INFORMATION FURNISHED BY ‘AVIATION TRAINING PARTNERS INTERNATIONAL INC.’ AS LEGAL, FINANCIAL OR OTHER ADVICE.

THE UNITS OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) OR THE SECURITIES OR “BLUE SKY” LAWS OF ANY STATE AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND SUCH LAWS. THE UNITS ARE SUBJECT TO RESTRICTION ON TRANSFERABILITY AND RESALE AND MAY NOT BE PLEDGED, TRANSFERRED, RESOLD OR OTHERWISE DISPOSED OF EXCEPT AS PERMITTED UNDER THE SECURITIES ACT AND SUCH LAWS PURSUANT TO REGISTRATION OR EXEMPTIONS THEREFROM. THE UNITS HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION OR OTHER REGULATORY AUTHORITY, NOT HAVE ANY OF THE FOREGOING AUTHORITIES PASSED UPON OR ENDORSED THE MERITS OF THIS OFFERING OR THE ACCURACY OR ADEQUACY OF THE OFFERING DOCUMENTS. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

THE OFFEREE, BY ACCEPTING DELIVERY OF THE OFFERING MATERIALS, AGREES TO RETURN THIS MEMORANDUM, ALL OTHER OFFERING MATERIALS AND ALL ACCOMPANYING OR RELATED DOCUMENTS TO THE COMPANY UPON REQUEST IF THE OFFEREE DOES NOT PURCHASE ANY OF THE UNITS OFFERED HEREBY.

THIS MEMORANDUM AND ALL OTHER OFFERING MATERIALS ARE SUBMITTED IN CONNECTION WITH THE PRIVATE OFFERING OF THE SERIES ‘A’ NON-VOTING UNITS AND DO NOT CONSTITUTE AN OFFER OR SOLICITATION BY ANYONE IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION IS NOT AUTHORIZED. ANY REPRODUCTION OR DISTRIBUTION OF THIS MEMORANDUM OR ANY OTHER OFFERING MATERIALS IN WHOLE OR IN PART, OR THE DIVULGENCE OF ANY OF THEIR CONTENTS, WITHOUT THE PRIOR WRITTEN CONSENT OF THE COMPANY, IS PROHIBITED. ANY OFFEREE ACTING CONTRARY TO THE FOREGOING RESTRICTIONS MAY PLACE ITSELF AND THE COMPANY IN VIOLATION OF FEDERAL OR STATE SECURITIES LAWS.

EACH OFFEREE MAY, IF IT SO DESIRES, MAY INQUIRIES OF MANAGEMENT OF THE COMPANY WITH RESPECT TO THE COMPANY’S BUSINESS OR ANY OTHER MATTERS SET FORTH HEREIN AND MAY OBTAIN ANY ADDITIONAL INFORMATION THAT SUCH OFFEREE DEEMS TO BE NECESSARY IN ORDER TO VERIFY THE ACCURACY OF THE INFORMATION CONTAINED IN THIS MEMORANDUM AND TO MAKE AND INVESTMENT DECISION (TO THE EXTENT THAT THE COMPANY POSSESSES SUCH INFORMATION OR CAN ACQUIRE IT WITHOUT UNREASONABLE EFFORT OR EXPENSE). IN CONNECTION WITH SUCH INQUIRY, ANY DOCUMENTS THAT ANY OFFEREE WISHES TO REVIEW WILL BE MADE AVAILABLE FOR INSPECTION AND COPYING OR PROVIDED, UPON REQUEST, SUBJECT TO THE OFFEREE’S AGREEMENT TO MAINTAIN SUCH INFORMATION IN CONFIDENCE AND TO RETURN THE SAME TO THE COMPANY IF THE RECIPIENT DOES NOT PURCHASE THE UNITS OFFERED HEREUNDER. ANY SUCH INQUIRIES OR REQUESTS FOR ADDITIONAL INFORMATION OR DOCUMENTS SHOULD BE MADE IN WRITING TO THE COMPANY ADDRESSED TO AVIATION TRAINING PARTNERS INTERNATIONAL INC. AT 1000 NORTH WEST ST, STE 1501, WILMINGTON DELAWARE 19801 USA, ATTENTION SAMUEL W MILLER.

Certain of the statements set forth under the captions “Executive Summary,” “The Company” and “Use of Proceeds” and set forth elsewhere in this Memorandum constitute “forward-looking statements.” Forward- looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words “estimate,” “project,” “intend,” “forecast,””anticipate,””plan,””planning,””expect,””believe,””will,””will likely,” ”should,” ”could,” ”would,” ”may” or words or expressions of similar meaning. All such forward-looking statements involve risks and uncertainties, including, but not limited to, statements regarding the marketing, sales, research and development programs of ‘ATPI’, the effect of competition and proprietary rights of third parties, the availability of additional financing and access to capital with respect to ATPI, and the period of time for which the proceeds of the Offering will enable ATPI to fund its operations. Therefore, prospective investors are cautioned that there can be no assurance that the forward-looking statements included in this Memorandum will prove to be accurate. In light of the significant uncertainties inherent to the forward-looking statements included herein, the inclusion of such

information should not be regarded as a representation or warranty by ATPI or any other person that the objectives and plans of ATPI will be achieved in any specific time frame, if at all. Except to the extent required by applicable laws or rules, ATPI does not undertake any obligation to update any forward-looking statements or to announce revisions to any of the forward-looking statements.

NASAA LEGEND

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THESE SECURITIES MAY BE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UDER FEDERAL AND STATE SECURITIES LAWS. INVESTORS SHOULD BE AWARE THAT THEY MAY NE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINATE PERIOD OF TIME.

44.55.170. THE INVESTOR MUST RELY ON THE INVESTOR’S OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED IN MAKING AN INVESTMENT DECISION IN THESE SECURITIES.

OF SAID ACT. THE MEMBERSHIPS HAVE NOT BEEN REGISTERED UNDER SAID ACT IN THE STATE OF FLORIDA. IN ADDITION, ALL OFFEREES WHO ARE FLORIDA RESIDENTS SHOULD BE AWARE THAT SECTION 517.061(11)(a)(5) OF THE ACT PROVIDES, IN RELEVANT PART, AS FOLLOWS: “WHEN SALES ARE MADE TO FIVE OR MORE PERSONS IN [FLORIDA], ANY SALE IN [FLORIDA] MADE PURSUANT TO [THIS SECTION] IS VOIDABLE BY THE PURCHASER IN SUCH SALE EITHER WITHIN 3 DAYS AFTER THE FIRST TENDER OF CONSIDERATION IN MADE BY THE PURCHASER TO THE ISSUER, AN AGENT OF THE ISSUER OR AN ESCROW AGENT OR WITHIN 3 DAYS AFTER THE AVAILABILITY OF THAT PRIVILEDGE IS COMMUNICATED TO SUCH PURCHASER, WHICHEVER OCCURS LATER.” THE AVAILABILITY OF THE PRIVILEGE TO VOID

SALES PUSUANT TO SECTION 517.061(11) IS HEREBY COMMUNICATED TO EACH FLORIDA OFFEREE. EACH PERSON ENTITLED TO EXERCISE THE PRIVILEGE TO AVOID SALES GRANTED BY SECTION 517,061(11)(A)(5) AND WHO WISHES TO EXERCISE SUCH RIGHT, MUST, WITHIN 3 DAYS AFTER THE TENDER OF ANY AMOUNT TO THE COMPANY OR TO ANY AGENT OF THE COMPANY (INCLUDING THE SELLING AGENT OR ANY OTHER DEALER ACTING ON BEHALF OF THE PARTNERSHIP OR ANY SALESMAN OF SUCH DEALER) OR AN ESCROW AGENT CAUSE A WRITTEN NOTICE OR TELEGRAM TO BE SENT TO THE COMPANY AT THE ADDRESS PROVIDED IN THIS CONFIDENTIAL EXECUTIVE SUMMARY. SUCH LETTER OR TELEGRAM MUST BE SENT AND, IF POSTMARKED, POSTMARKED ON OR PRIOR TO THE END OF THE AFOREMENTIONED THIRD DAY. IF A PERSON SENDING A LETTER, IT IS PRUDENT TO SEND SUCH A LETTER BY CERTIFIED MAIL, RETURN RECEIPT REQUESTED, TO ASSURE THAT IT IS RECEIVED AND ALSO TO EVIDENCE THE TIME IT WAS MAILED. SHOULD A PERSON MAKE THIS REQUEST ORALLY, HE MUST ASK FOR WRITTEN CONFIRMATION THAT HIS REQUEST HAS BEEN RECEIVED.

THE MISSOURI SECURITIES LAW OF 1953, AS AMENDED. THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER SAID ACT IN THE STATE OF MISSOURI UNLESS THE SECURITIES ARE SO REGISTERED, THEY MAY NOT BE OFFERED FOR SALE OR RESOLD IN THE STATE OF MISSOURI EXCEPT AS A SECURITY IN A TRANSACTION EXEMPT UNDER SAID ACT.

THE COMPANY HAS TAKEN NO STEPS TO CREATE AN AFTER MARKET FOR THE MEMBERSHIPS OFFERED HEREIN AND HAS MADE NO ARRANGEMENTS WITH BROKERS OF OTHERS TO TRADE OR MAKE A MARKET IN THE MEMBERSHIPS.

TRANSFERRED, OR RESOLD EXCEPT IN COMPLIANCE WITH SUCH ACT AND APPLICABLE RULES PROMULGATED THEREUNDER.

THE INVESTOR MUST RELY ON THE INVESTOR’S OWN EXAMINATION OF THE COMPANY CREATING THE SECURITIES, AND THE TERMS OF THE OFFERING INCLUDING THE MERITS AND RISKS INVOLVED IN MAKING AN INVESTMENT DECISION ON THESE SECURITIES.

TWENTY PERCENT (20%) OF SUCH INVESTORS NET WORTH (EXCLUDING PRINCIPLE RESIDENCE, FURNISHINGS THEREIN AND PERSONAL AUTOMOBILES). EACH PENSSYLVANIA RESIDENT MUST AGREE NOT TO SELL THESE SECURITIES FOR A PERIOD OF TWELEVE (12) MONTHS AFTER THE DATE OF PURCHASE, EXCEPT IN ACCORDANCE WITH WAIVERS ESTABLISHED BY RULE OR ORDER OF THE COMMISSION. THE SECURITIES HAVE NOT BEEN ISSUED PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIRMENT OF THE PENNSYLVANIA SECURITIES ACT OF 1212. NO SUBSEQUENT RESALE OR OTHER DISPOSITION OF THE SECURITIES MAY BE MADE WITHIN 12 MONTHS FOLLOWING THEIR INITIAL SALE IN THE ABSENCE OF AN EFFECTIVE REGISTRATION, EXCEPT IN ACCORDANCE WITH WAIVERS ESTABLISHED BY RULE OR ORDER OF THE COMMISSION, AND THEREAFTER ONLY PURSUANT TO AN EFFECTIVE REGISTRATION OR EXEMPTION.

A NET WORTH (EXCLUSIVE OF HOME, FURNISHINGS AND AUTOMOBILES) OF TWO HUNDRED FIFTY THOUSAND DOLLARS ($250,000), AND

THE PURCHASE PRICE OF MEMBERSHIPS SUBSCRIBED MAY NOT EXCEED TWENTY PERCENT (20%) OF THE NET WORTH OF THE SUBSCRIBER; AND

“TAXABLE INCOME” AS DEFINED IN SECTION 63 OF THE INTERNAL REVENUE CODE OF 1986, AS AMENDED, DURING THE LAST TAX YEAR AND ESTIMATED “TAXABLE INCOME” DURING THE CURRENT TAX YEAR SUBJECT TO A FEDERAL INCOME TAX RATE OF NOT LESS THAN THIRTY-THREE PERCENT (33%).

The following summary is qualified in its entirety by the detailed information appearing elsewhere in this Memorandum and by the contents of the other documents included herewith. While this Memorandum can provide you with some information relating to the subject headings set forth, the information provided is not necessarily a complete or exclusive discussion of that subject.

Prospective investors are urged to read this Memorandum in its entirety, including the Appendices and all Exhibits.

Thereafter, Series ‘A’ Common Units will receive a prorated capital gains profit distribution determined by the board of directors on an annual basis of the net profits. All excess income not used by the Company will be held

in the reserve account to ensure its reasonable financial status under industry standards determined by the board of directors and the balance will be distributed with final distribution of profits.

Aviation Training Partner’s International Inc. is a Delaware Chapter “C” Corporation with its registered agent located at 1000 North West Street, STE 1501, Wilmington Delaware 19801 USA, escrow, financial management and legal services located at 712 Country Club Drive, Hampstead North Carolina 28443, and numerous manufacturing, support and training facilities with new plant development as part of its portfolio brought together under this filing. See business plan attached…

ATPI has identified and acquired several type certificated aircraft to be placed back into production with modernized production techniques specifically for the aircraft training and personal aircraft markets. Such as the Tiger and Cougar Aircraft series designs, and modernized versions in development with Design, Analysis, and Research Corporation (“DAR”) the leading research development company responsible for most if not all of the new aircraft designs in production today. The principals of ATPI have had an extensive background in this specific arena for the past 40 years, including introduction of new technologies to the markets, ATPI plans on the introduction of passenger air-taxi’s both monitored and drone in addition to its goals within the training and manufacturing of new aircraft series. While address the need for new pilot programs, type and currency certificates on existing aircraft.

An investment in the UNITS offered hereby is speculative in nature, involves a high degree of risk, and should not be made by an investor who cannot bear the economic risk of its investment for an indefinite period of time and who cannot afford the loss of its entire investment. Each prospective investor should consider carefully the following risk factors associated with the Offering, as well as other information contained elsewhere in the Memorandum before making an investment.

We have little operating history under the new formation and there can be no assurance that we will be profitable

ATPI has started operations with personal funds from its formation officers and will acquire its base of operations on closing. Accordingly, ATPI has limited operating history under this new formation. Potential investors should evaluate us in light of the expenses, delays, uncertainties, and complications typically encountered by early-stage businesses and corporate mergers, many of which will be beyond our control. These risks include (i) lack of sufficient capital, (ii) unanticipated problems, delays, and expenses related to product development and implementation, (iii) lack of intellectual property, (iv) licensing and marketing difficulties, (v) competition, (vii) technological changes, (viii) lack of external sources of financing, and (ix) uncertain market acceptance of our products and services.

There exists an inherent uncertainty regarding market potential and market

The Companies success will depend on economic fluctuations that will fuel sales and revenue within the general aviation market.

Our operations expose us to numerous and sometimes conflicting legal and regulatory requirements, and violation of these requirements could harm our business.

ATPI has as a result of its mergers in-house legal counsel and will continue to retain the services of attorneys that specialize in the appropriate areas to ensure compliance with all state, federal and international laws.

The Company may require additional financing in addition to this Offering which may not be available.

ATPI’s future success may depend on our ability to raise additional funds and financing. While no commitments to provide additional funds have been made by management. Our ability to arrange external financing in the future will depend in part upon the prevailing capital market conditions, as well as our business performance. There can be no assurance that we will be successful in our efforts to arrange additional financing on satisfactory terms.

If additional financing is raised there can be a dilution of the common stock units and holders may suffer additional dilution as a result. If adequate funds are not available, or are not available on acceptable terms, we may not be able to take advantage of opportunities, or otherwise respond to competitive pressures and remain in business.

There are restrictions on transfer and no market for the Series ‘A’ Non-voting Units; therefore, you may not be able to sell when you want to.

At this time, ATPI plans to remain privately held, therefore, no public market for the Series ‘A’ Non-voting Units currently exists or will result from this Offering. In addition, the Series ‘A’ Non-voting Units are being offered pursuant to exemptions from registration under federal and state securities laws and therefore will be subject to substantial restrictions on transfer, although a form ‘D’ filing is planned with the Securities and Exchange Commission under the Securities Act of 1933, as amended. Accordingly, Series ‘A’ Non-voting Units may be transferred only under appropriate exemptions and only if the transferee complies with appropriate exemptions from the registration requirements of federal and any relevant state securities laws.

Consequently, holders of Series ‘A’ Non-voting Units may not be able to liquidate their investment in the event

of an emergency or for any other reason, and Series ‘A’ Non-voting Units may not be readily accepted as collateral for a loan. The purchase of Series ‘A’ Non-voting Units, therefore, should be considered only as a long-term investment.

Series ‘A’ Non-voting Units

The holders of Series ‘A’ Non-voting Units and the Series ‘A’ Common Units are not entitled to vote. Upon liquidation, dissolution, or winding up of our company, the holders of Common Series ‘A’ Non-voting Units will be entitled to priority distribution in all our assets that are legally available for distribution, after payment of all debts and other liabilities and the liquidation preference of, and payment of any accrued distributions on, any outstanding Common Units.

Holder of Series ‘A’ Non-voting Units shall not be permitted to transfer such Series ‘A’ Non-voting Units to any party who is not a Series ‘A’ Non-voting Unit holder of the Company without first obtaining the prior consent of the Company. In the event such consent is granted, existing holders of Series ‘A’ Non-voting Units shall be entitled to a right of first refusal with respect to such transfer of Series ‘A’ Non-voting Units.

The Company is the sole holder of the outstanding common units. The common units are entitled to receive capital gains on a prorated basis as determined by the Company.

Subject to the terms and conditions set forth in this Memorandum, there are being offered 100,000 Offered Series ‘A’ Non-voting Units at a price of $2,500 per unit.

ATPI plans to use the proceeds of this Offering to further and execute its objectives at their sole discretion as detailed in this Memorandum.

The corporate officers of ATPI receive a salary and other compensation as part of their responsibilities, but do not receive any salary for their handling of this Offering.

Any investor purchasing Series ‘A’ Non-Voting Units in connection with this Offering shall be required to execute ATPI’s Operating Agreement as it may be amended from time to time.

In connection with this Offering, ATPI may use the services of one or more outside placement agents and may pay a placement agent fee or other compensation for such services. Purchasers of the Series ‘A’ Non-voting Units will be required to execute and deliver to ATPI a Subscription Agreement if the form attached as Appendix A. We reserve the right to reject any subscription in whole or in part and to allocate to any potential subscriber a number of Series ‘A’ Non-voting Units less than the amount subscribed for by such potential subscriber, for any or no reason and without notice. We expect to conduct a Closing as soon as we deem it appropriate and to conduct additional Closing thereafter. The Offering Price of the Series ‘A’ Non-voting Units has been arbitrarily determined by ATPI based upon its projections and does not necessarily bear any relationship to ATPI’s asset value, net worth, revenues or other established criteria of value, and should not be considered indicative of the actual value of the Series ‘A’ Non-voting Units.

No market exists for the trading of any of our units. Our units have not been registered under the Securities Exchange Act of 1933, as amended (the “Exchange Act”). Further, the Series ‘A’ Non-voting Units have not been registered under the Securities Act, and will be “restricted securities” under the Securities Act. Accordingly, the Series ‘A’ Non-voting Units may not be resold prior to registration under the Securities Act and applicable state securities laws. Series ‘A’ Non- Voting Units certificates for the Series ‘A’ Non-voting Units are Warrants (and for Warrants upon conversion or exercise, respectively) will contain a legend in substantially the following form:

THE UNITS REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES OR “BLUE SKY” LAWS OF ANY STATE OF THE UNITED STATE. THE UNITS MAY NOT BE SOLD, TRANSFERRED OR ASSIGNED IN THE ABSENCE

OF AN EFFECTIVE REGISTRATION STATEMENT FOR THE UNITS UNDER APPLICABLE SECURITIES LAWS, OR UNLESS OFFERED, SOLD OR TRANSFERRED PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THOSE LAWS.

IN ADDITION, TRANSFERS, VOTING AND OTHER MATTERS IN RESPECT TO THE UNITS REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO AN OPERATING AGREEMENT DATED AS OF AUGUST 2018 AMONG THE COMPANY AND CERTAIN SERIES ‘A’ NON-VOTING UNITS HOLDERS NAMES THEREIN, A COPY OF WHICH AGREEMENT IS ON FILE AT THE PRINCIPLE OFFICE OF THE COMPANY AND MAY BE OBTAINED WITHOUT CHARGE UPON WRITTEN REQUEST TO THE COMPANY.

In order to subscribe for the Series ‘A’ Non-voting Units, prospective investors must complete, execute and deliver the following, as applicable, to ATPI:

A fully completed Subscription Agreement (including completion of the Accredited Investor Certification attached thereto) and Signature Page evidencing such prospective investor’s execution of the Subscription Agreement and the number of Series ‘A’ Non-voting Units for which subscription is being made.

A signed copy of the Signature Page of the Operating Agreement evidencing such prospective investor’s execution of the Series ‘A’ Non-Voting Units holder’s agreement; and

A personal or business check or money order made payable to the designated agent if the amount is under

$10,000 USD, if the amount is over $10,000 USD, then a wire transfer is requested to:

Any documents or information concerning ATPI which a prospective purchaser reasonably requests to inspect or have disclosed to IT/HIM/HER will be made available or disclosed, subject in appropriate circumstances to receipt by us of reasonable assurances that such documents or information will be maintained in confidence.

If you require additional information or have any questions please contact ATPI Attention: Chuck Vaughn

Tel: 904-714-5724

Email: chuck@aviationTPI.com